The 2008 Bust Explained – And The Slippery Slopes Of Global Economic Growth

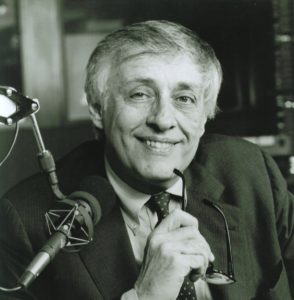

With Philip Coggan, Ann LeeAdded 10.10.18. In this 2011 episode Milt talks with two authors about the 2008 financial meltdown in the U.S. and necessary course corrections going forward, as economy-builders traverse the slippery slopes of growth. One guest is Economist columnist and former Financial Times writer Philip Coggan. He is author of “Paper Promises: Debt, Money, And The New World Order.” Another is former Wall Street investment banker and hedge fund partner, later an adjunct professor at the International Affairs School of NYU, Ann Lee. She is author of “What The U.S. Can Learn From China: An Open-Minded Guide To Treating Our Greatest Competitor As Our Greatest Teacher.” Flashing forward: As of late August 2018, the U.S. public debt had grown 50 percent since this episode aired, from $14 trillion to $21 trillion. Seventy percent of that more recent U.S. public debt was owned by either the U.S. government, the U.S. Federal Reserve, or U.S. investors. The rest was owned by foreign investors, foremost those in China and Japan. Coggan accents in the episode that rising public debt means many public health care and Social Security beneficiaries will not be paid all or most of what they are owed. Meanwhile, context around China’s impressive economic growth over recent decades has advanced since the episode aired. This 2017 PBS analysis pinpoints three big risks for China: financial instability from bad lending; accelerating private de-capitalization; and growth constraints stemming from authoritarian mis-rule.